child tax credit portal phone number

If you dont have internet access or cant use the online tool you can unenroll by contacting the IRS at the phone number on your Advance Child Tax Credit Outreach Letter you should have received from the IRS in June. The credit was made fully refundable.

The deadline to unenroll or update your information on the child tax credit update portal was 1159 pm.

. Already claiming Child Tax Credit. For more information see the Advance Child Tax Credit Payments in 2021 page on IRSgov. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters.

Choose the location nearest to you and select Make Appointment. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children. Families were eligible to get half of their CTC as advance monthly payments from July to December 2021 and the other.

For assistance in Spanish call 800-829-1040. How to contact the irs about the 2021 child tax credit even though families are automatically signed up they may want to change the payment type or. The Child Tax Credit provides money to support American families helping them make ends meet.

For assistance in Spanish call 800-829-1040. Heres how to schedule a meeting. Check Out IRS Child Tax Credit 2021 Portal Tool Payment Calculator opt out Helpline Number from this page.

You will see the following screen on your computer. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Child tax credit portal phone number.

If the irs has processed your 2020 tax return or 2019 tax return these monthly payments will be made starting in july and through. Child Tax Credit Update Portal to Close April 19. Child Tax Credit New Online Portal And Irs Tools Help Families Before July Payment.

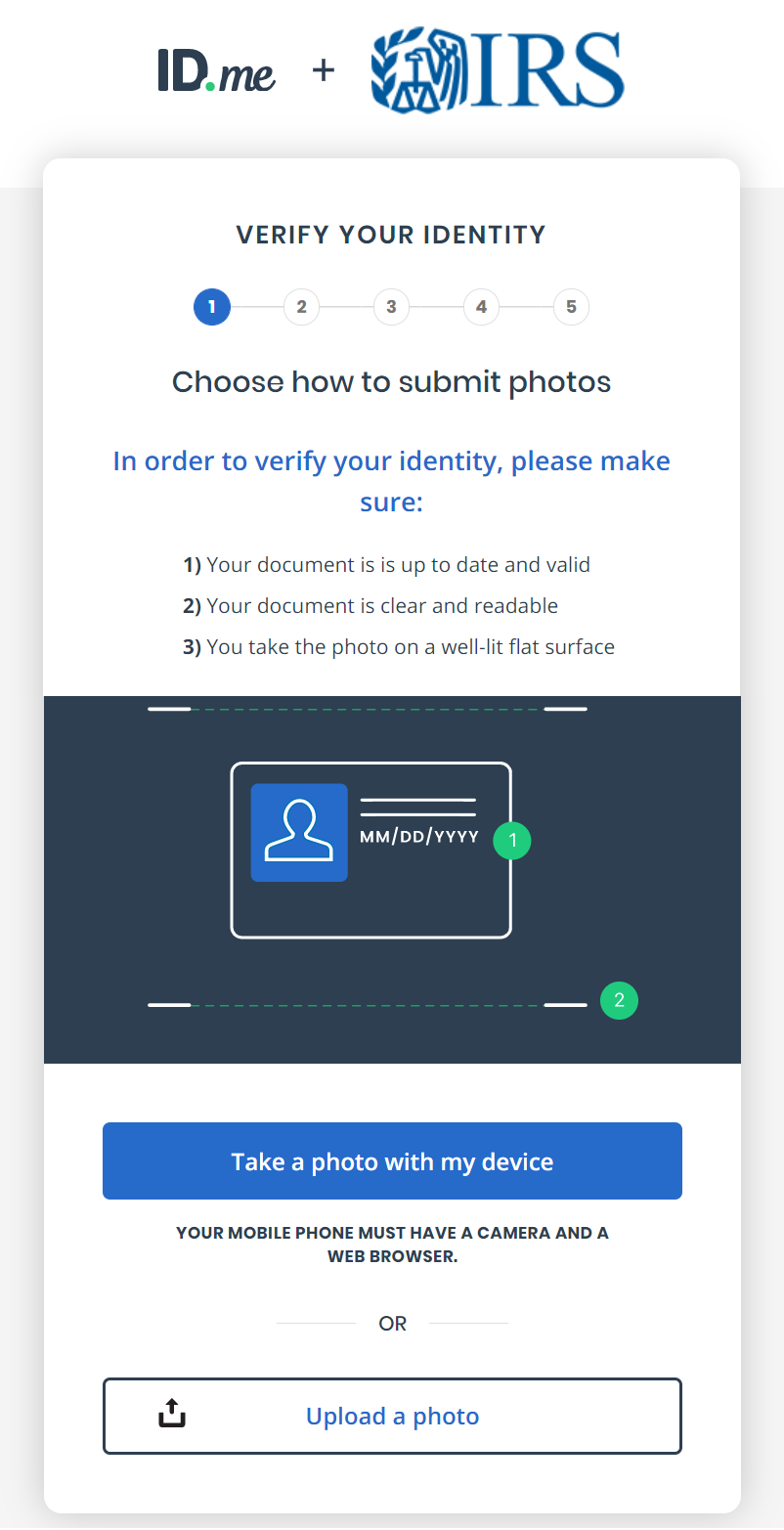

Creating an account to access the Child Tax Credit Portal. The Child Tax Credit CTC is a federal credit that helps families afford the everyday expenses of raising a child. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you.

Call the IRS about your child tax credit questions from the below phone number. Creating an account for the CTC UP portal takes 20-30 minutes to complete if you have everything listed below. The amount you can get depends on how many children youve got and whether youre.

1-800-829-1040 Regardless of the state you live in the IRS representatives are available Monday through Friday between 7 AM and 7 PM your local time. You need that information for your 2021 tax return. 15 but the millions of payments the irs has sent out.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. To help families during the COVID-19 pandemic the US. Get your advance payments total and number of qualifying children in your online account.

Phone lines in puerto rico are open from 8 am. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls and not enough staff to deal with the procedural demands of. Making a new claim for Child Tax Credit.

You can also use the portal to unenroll from receiving the monthly payments if you are not eligible or prefer to receive the full. The credit amount was increased for 2021. Upload your photos using your phone.

To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a bank account to receive your payments quickly by direct deposit. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

Updated on 72121. Make sure you have. Upload your photos using your.

To be eligible for this rebate you must meet all. Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you. The Child Tax Credit Update Portal is no longer available.

The number to try is 1-800-829-1040. Enter in your phone number and press the blue Continue button. The Child Tax Credit helps all families succeed.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Government made changes to the CTC for tax year 2021.

By making the Child Tax Credit fully refundable low- income households will be. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for other qualifying children under age 18. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

Child tax credit update portal. This portal closes Tuesday April 19 at 1201 am.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Quicko Gst Tax Credits Tax Income Tax

Tax Consultation With An Tax Expert Over A Phone Eztax India Income Tax Return Tax Refund Friday Motivation

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Provisional Itc Credit On Gst Portal ज एसट प र टल पर प र व शनल आईट स Tax Credits Portal Credits

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Childctc The Child Tax Credit The White House

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Compliance Calendar For Fy 2019 20 It Gst Tds Eztax In Filing Taxes Compliance Tax Services

Tax Consultation With An Tax Expert Over A Phone Eztax India Tax Tax Reduction Filing Taxes

Pin By The Taxtalk On Income Tax In 2021 Tax Refund Income Tax Chartered Accountant